Introduction

The UK government’s Making Tax Digital (MTD) programme has been gradually transforming how tax is recorded, submitted, and managed. The next phase, MTD for Income Tax (MTD ITSA), will be mandatory from April 2026 for many taxpayers. For accountants, this represents both a challenge and an opportunity. Firms that prepare their clients early will not only ensure compliance but can also provide more proactive financial advice, improve efficiency, and modernise workflows.

This comprehensive guide explores what MTD ITSA is, who it affects, practical steps accountants can take, common challenges, and how to leverage digital software such as Papercare working papers to make the transition smoother.

What is MTD for Income Tax (MTD ITSA)?

Making Tax Digital is a government initiative aimed at making tax administration more efficient, accurate, and user-friendly. It started with VAT in 2019, and the next stage applies to Income Tax.

Under MTD ITSA:

- Individuals such as sole traders and property landlords must keep digital records of all income and expenses.

- Quarterly updates must be submitted digitally to HMRC using MTD-compatible software.

- End-of-year submissions will still be required to reconcile total income and tax owed.

The goal is to reduce errors, improve compliance, and give accountants better insights into client financial data throughout the year.

Who is affected – dates and thresholds

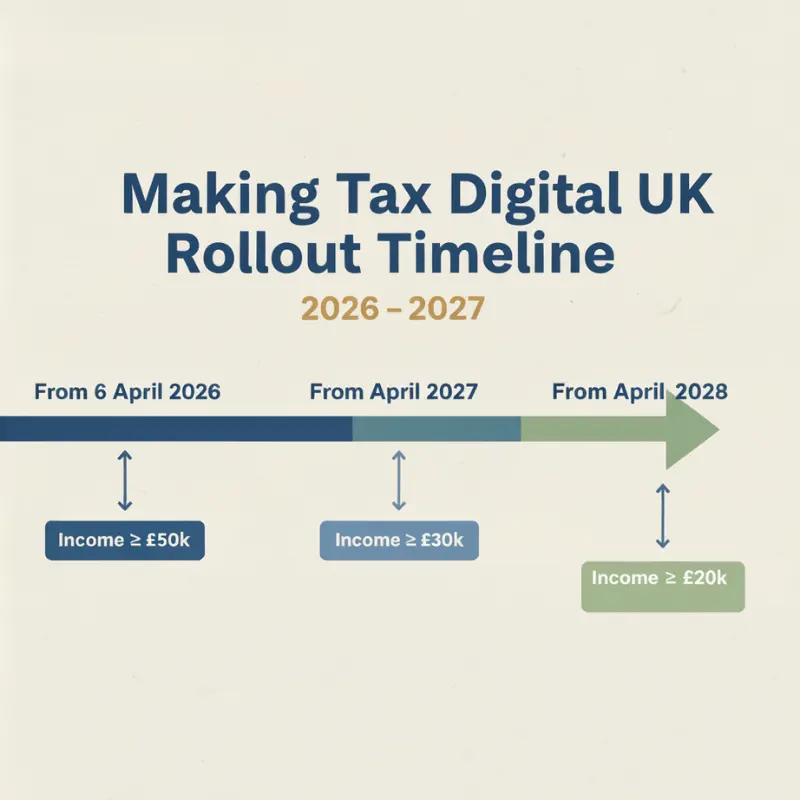

MTD ITSA will be phased in gradually:

- April 2026: Taxpayers with income above £50,000 will be in scope.

- April 2027: Taxpayers with income between £30,000 – £50,000 are expected to be brought in.

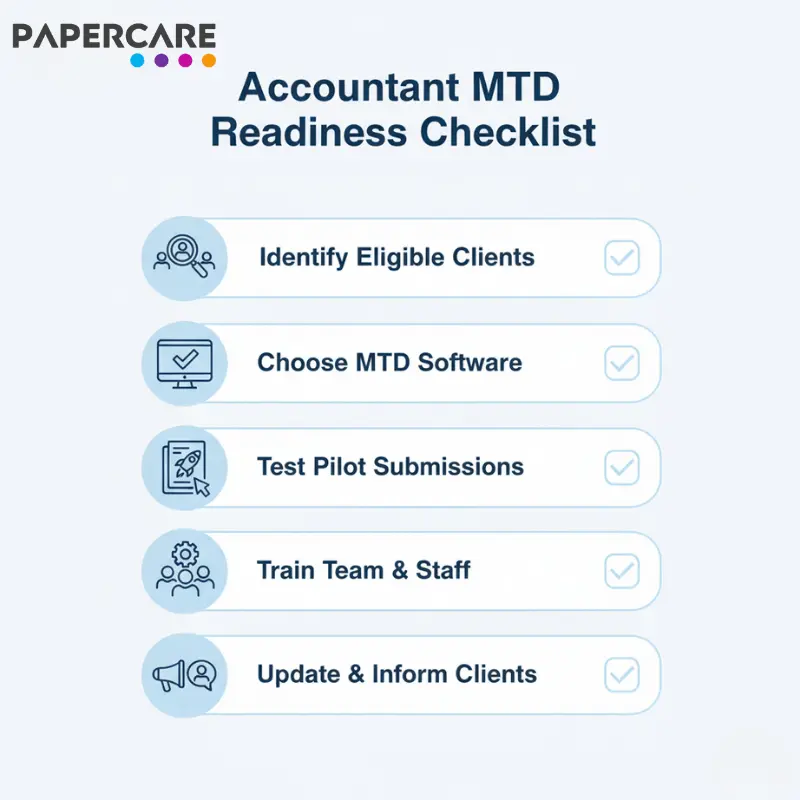

HMRC will notify affected individuals, but accountants should proactively identify clients who fall into these categories. Those below £30,000 may join voluntarily, but exemptions exist for those who are digitally excluded due to age, disability, or location.

Check if a client is eligible to ensure compliance.

Why accountants should act now

MTD ITSA will affect nearly every stage of a traditional accounting workflow. Waiting until the last minute can create stress, errors, and potential penalties. Early action allows accountants to:

- Identify which clients will be affected and prioritise planning

- Upgrade software and integrate with working papers systems

- Train staff and educate clients to ensure smooth adoption

- Build stronger advisory services using real-time data

Proactive preparation also positions a firm as a modern, forward-thinking advisory partner rather than just a compliance provider.

6-step preparation plan for accountants

1. Identify and segment clients

Start by creating a comprehensive client list, noting:

- Type of client (sole trader, landlord, other)

- Annual income

- Complexity of accounts (e.g., multiple income streams)

Segment clients based on MTD start dates to ensure prioritisation. Clients with higher incomes or complex structures should be addressed first.

2. Choose MTD-compatible software

Clients will need software that can:

- Record digital transactions

- Submit quarterly updates to HMRC

- Maintain an audit trail

Where spreadsheets are still used, either bridging tools or a full migration to cloud solutions is recommended. For detailed guidance on spreadsheet risks and migration, see: Common Excel and Spreadsheet Issues in Accounting Workflows and How to Migrate from Spreadsheets to a Cloud Working Papers System.

3. Standardise workflows

Quarterly reporting requires consistent and repeatable processes:

- Reconcile client accounts regularly

- Review each submission for accuracy

- Keep documentation in a centralised system such as a cloud working papers solution

This reduces errors, ensures audit-readiness, and frees staff to focus on higher-value advisory work. Learn more about cloud compliance in Why Cloud-Based Working Papers Are the Future of Compliance for UK Accountants.

4. Train staff and educate clients

Training should include:

- Using MTD software and Papercare for record management

- Reviewing and correcting digital data

- Explaining the new reporting process to clients

Clients benefit from simple guides and walkthroughs, which reduces confusion and builds confidence in digital submissions.

5. Test early and sign up

Take advantage of HMRC’s pilot schemes to trial MTD submissions. Testing allows you to:

- Identify software integration issues

- Ensure workflows are efficient

- Build confidence in digital submission processes

Create digital records for MTD ITSA for guidance.

6. Monitor deadlines and exemptions

Keep track of:

- Client-specific deadlines

- Penalty rules for late or incorrect submissions

- Applications for exemption in case of digital exclusion

Exemptions may apply due to:

- Age

- Disability

- Remote location

See HMRC guidance: Eligibility and exemptions for MTD ITSA.

Common challenges and practical solutions

Spreadsheet-only clients

Spreadsheets alone are prone to:

- Human error

- Version control issues

- Difficult reconciliation for multiple income sources

Cloud solutions like Papercare provide automated workflows and ensure data is accessible and traceable.

Complex income streams

Clients with multiple trading or property incomes must keep separate, well-documented records. Merging or mixing data increases errors. Centralised working papers systems simplify these complexities.

Penalties and compliance

Late submissions or missing updates attract penalties under a points-based system, as recently reported by MoneyWeek. Firms should implement internal reminders and checks to avoid penalties.

Advisory opportunities for your firm

MTD ITSA allows accountants to offer more than compliance:

- Cashflow forecasting using quarterly data

- Tax planning advice based on near real-time submissions

- Bookkeeping optimisation with integrated working papers

Automation and AI can enhance these processes. See: How AI Is Transforming Working Papers for UK Accountants.

FAQs

- When does MTD ITSA start?

April 2026 for income over £50,000; April 2027 for income between £30,000–£50,000. - Will clients still submit a Self-Assessment return?

Yes, an end-of-year statement is still required. - What software is required?

MTD-compatible software capable of creating records and submitting updates. See HMRC guidance. - Can a client be exempt?

Yes, if digitally excluded. See HMRC exemptions. - Are penalties changing?

Yes, HMRC now applies a points-based system. See MoneyWeek – Changes to tax penalties.

Conclusion

MTD ITSA represents a major digital shift in UK accounting. Firms that act early by:

- Identifying in-scope clients

- Implementing MTD-compatible software

- Standardising workflows

- Leveraging cloud working papers

This will not only ensure compliance but also improve client relationships and create advisory opportunities.

For practical support, explore Papercare Working Papers Software or contact our team to see how your firm can transition smoothly to MTD ITSA.