In the fast-evolving accounting landscape of the UK, working papers are at the heart of a firm’s accuracy, efficiency, and regulatory compliance. But many practices still rely heavily on spreadsheets, manual reviews, and repetitive tasks which are slow, prone to error, and hard to scale.

Artificial Intelligence (AI) is rapidly changing that. For accountants handling working papers, AI doesn’t just add incremental improvements, it enables entirely new workflows, sharper insights, and more time for advisory value. Here’s how.

1. The Role of Working Papers & Existing Challenges

Working papers are detailed documentation of the work done to prepare accounts, audits or tax returns. They’re essential for:

- tracing financial transactions

- supporting audit trails

- ensuring regulatory compliance (UK GAAP, HMRC, etc.)

- maintaining consistency across clients

But accountants often face challenges:

- Version control issues when many people edit files separately

- Time-consuming manual data entry and reconciliations

- Difficulty in locating relevant technical standards or past precedents

- Drafting communications (emails, client letters) for differing clients while maintaining tone and compliance

- Tax queries that require referencing multiple sources and sometimes non-standard cases

2. Key Ways AI is Transforming Working Papers in the UK

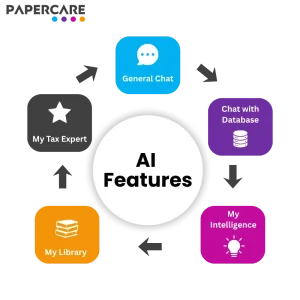

Here are the major ways AI is already making a difference in working papers, especially for accountants in the UK, along with examples of features that deliver these improvements available in Papercare’s AI Working Papers platform.

a) On-Demand AI Assistant for Communication, Research & Support

AI tools like a “General Chat” assistant help accountants instantly:

- research accounting/finance/tax technical issues without digging through many PDFs or guidance docs

- analyse financial reports or data summaries quickly

This reduces time spent searching for standards, worrying about tone or format, and boosts consistency across your firm.

b) Data Retrieval & Real-Time Insights from the Working Papers Database

With features akin to “chat with database”, accountants can ask the system to fetch profit & loss items, balance sheets, journal entries, control accounts, lead schedules etc., without navigating multiple systems:

- instantly compare current vs prior periods

- spot unusual transactions or variances

- generate narrative summaries for reviews or board packs

This transforms what used to be a manual exercise into near-instant insights, saving time and reducing errors.

c) Knowledge Library / Firm-Specific Technical Support

Accountants often refer to technical manuals, firm policies, HMRC guidance, and internal precedent documents. AI-powered knowledge bases like “My Intelligence” let you upload these and query them:

- ask questions using firm policy, standards or tax guidance

- reduce repetition, avoid misinterpretation of rules

- benefit especially when handling non-routine cases or tricky client issues

d) Drafting Client Communications More Efficiently

Preparing professional client letters, client onboarding documents, or tax strategy memos often involves custom-tailored writing. An AI drafting tool (e.g. “My Library”) can help:

- by prompting structured inputs

- producing drafts that match firm style

- ensuring consistent compliance and reducing back-and-forth edits

This is especially helpful in busy periods or for smaller firms without dedicated communications resources.

e) Specialised Tax Queries & Advisory Support

Tax rules in the UK can be complex like corporation tax, reliefs, allowances, UK GAAP vs IFRS, HMRC rulings, etc. AI specialised feature like “My Tax Expert” for tax help with:

- scenario modelling (e.g. effect of different reliefs)

- referencing trusted sources like gov.uk or HMRC guidance

- producing summaries or internal notes to support decision making

This raises confidence, speeds up turnaround, and ensures well-informed advice.

3. Overcoming Concerns: Accuracy, Compliance & Adoption

Despite these benefits, many accountants have concerns. Here’s how those concerns are addressed:

| Concern | How AI and Modern Tools Help |

| Accuracy and errors | AI-driven checks, version control, audit trails, consistent data-driven insights reduce human error. |

| Compliance with UK accounting / tax law | Built-in references to UK standards, ability to upload firm-specific guidance, tools that update with regulatory changes. |

| Data security & confidentiality | Secure cloud infrastructure, UK-based servers, encryption, access permissions. |

| Change management / staff adoption | Training, simple interface, incremental usage (start with drafting / queries), showing early wins helps with buy-in. |

4. The Future: What UK Accountants Should Expect & Prepare For

The pace at which AI is being adopted in accounting is accelerating. Recent reports show that many UK accountants are already using, or planning to use, AI for efficiency and advisory functions.

Here are a few trends to watch:

- greater use of live data and real‐time working papers (cloud + connected systems)

- AI assistants becoming more embedded in audit & compliance workflows

- more trust in AI’s outputs, especially when backed by firm-specific knowledge libraries

- rise in advisory services, where accountants focus more on insights than just producing accounts

- evolving regulatory guidelines around AI usage, transparency and audit quality Financial Times

5. Conclusion: How to Begin Integrating AI into Working Papers

If you’re an accountant in the UK wondering where to start with AI in working papers, here are some first steps:

- Identify repetitive tasks (drafting, data fetching, reconciliations) that eat time and see if AI tools can support them.

- Collect your firm’s technical references, guides, policies, and see if you can build or use a knowledge base.

- Choose software that supports versioning, audit trails, UK-compliance, and strong security.

- Train your team and pilot with one or two features first (e.g. AI-enabled drafting or database queries).

- Monitor outcomes: time saved, error rates, staff satisfaction which helps justify more investment.

Final Thoughts

AI is not just a buzzword for UK accountants, it’s becoming a core enabler of better working papers. From speeding up data retrieval to improving accuracy, from drafting communications to deeply understanding tax rules, the transformation is real. Firms that embrace these changes will find themselves more efficient, more confident, and better equipped for the future of accounting.